What's this strategy?

An 'A' rated Canadian financial institute

grants $100,000 to eligible clients who leverage this money to

invest in high-growth solid growth funds. The cost of investment is

around $300 a month.

What is leverage investment?

This is the same approach, where the bank

pays a lower rate of interest to customers on their deposits and

then 'leverages' the same money to finance mortgages/loans for a

higher interest rate.

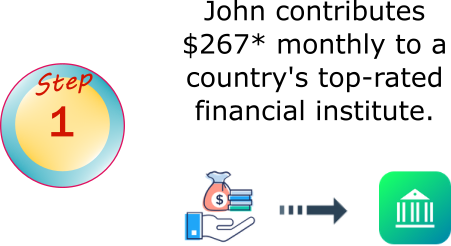

Let's review the strategy 'step-by-step' with an example:

with an example:

Start with a light wallet...

Our client does not need to commit to a

heavy cost. A small monthly payment is sufficient to support a

large portfolio starts with a value of $100,000. A large portfolio

means large returns.

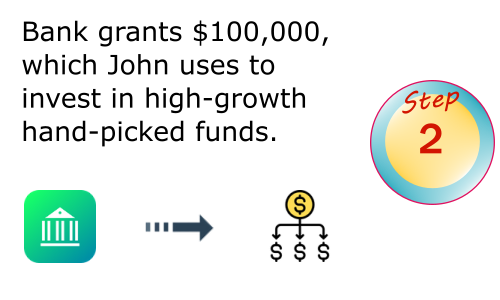

Pick & choose...

A long list of high-performing funds

available for clients to choose from. In fact, a couple of free

switches are allowed per year with no penalty or fee.

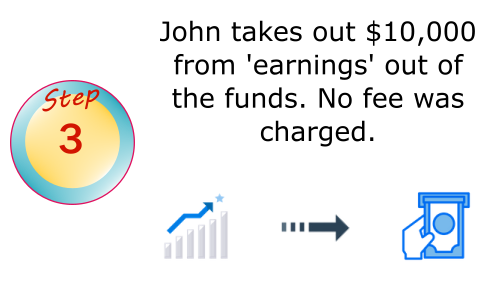

Take out your earnings, free...

Unlike other mutual funds, this product

allows clients to take out the earnings of up to 10% of the

portfolio per year absolutely free. After withdrawal, the rest of

the unsold fund units continue to grow and keep building more

returns for the next withdrawal

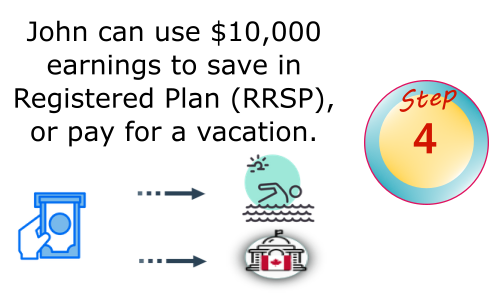

Enjoy or re-invest...

There is absolutely no restriction on what

you want to do with the money which is taken out from the

portfolio. Book a cruise, buy a car or simply re-invest to support

your retirement. It's totally up to you.

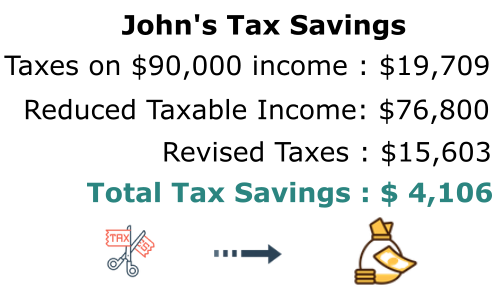

Save Tax ....

Every penny contributed to keeping the

funds running, is considered as cost-of-investment which is fully

deductible (T1 Line 22100) in your personal tax file. On average

almost 1/3 of the tax is saved ( 1/3 of 300 = $100). That means,

effectively, your monthly contribution is only about $200

($300-$100=$200).

Save more tax....

We recommend any withdrawals from the

portfolio, to re-invest into retirement plans (RRSP) to save more

income tax. If you do, the cost of investment is virtually paid off

by income tax refunds.

Build wealth, save tax, repeat...

Mutual funds we recommend have a solid

history of double-digit returns. Then why not continue with the

same strategy each year to save income tax and build long-term

wealth.

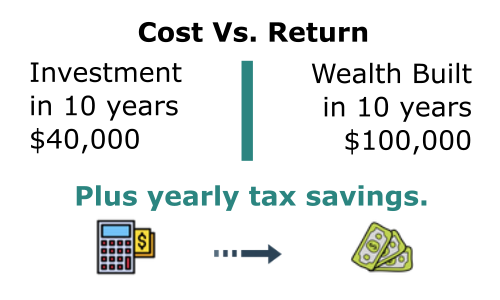

Return on investment ....

On average, over a period of 10 years, the

total cost of investment counts around $40,000 for our clients.

This cost is further reduced by the tax savings depends upon how

the withdrawals are utilized. If re-invested, the overall returns

of the portfolio can easily exceed $100,000.

What our clients say...

Some of the customers are using this

strategy as a secondary source of income. Other re-invest for

retirement. But all of them definitely recommend it to their

friends and family.

with an example:

with an example:

![]() 416-800-1810

416-800-1810

![]() support@money-simple.ca

support@money-simple.ca

![]() 9900 McLaughlin Road N

9900 McLaughlin Road N